Here’s an extremely unhelpful but extremely honest answer: it depends.

There are a multitude of factors that will determine if an individual or a couple can purchase a home in Toronto today, not to mention when.

But what about where? And of course, how?

The intersection of the answers to these questions will ultimately determine any potential buyer’s path.

Buying your first home in Toronto today will depend on your down payment, your income, and of course – prevailing interest rates, all three of which will determine your affordability.

But there is another factor that could play an even greater role than affordability, and that is simply your expectations.

The Truth About the Toronto Real Estate Market

When I hear a person lament, “Toronto is so unaffordable. I can’t buy a property in today’s market,” my immediate response is, “Who is this person? How old are they? Where do they want to live? What are their financial qualifications? What property type are they looking at?”

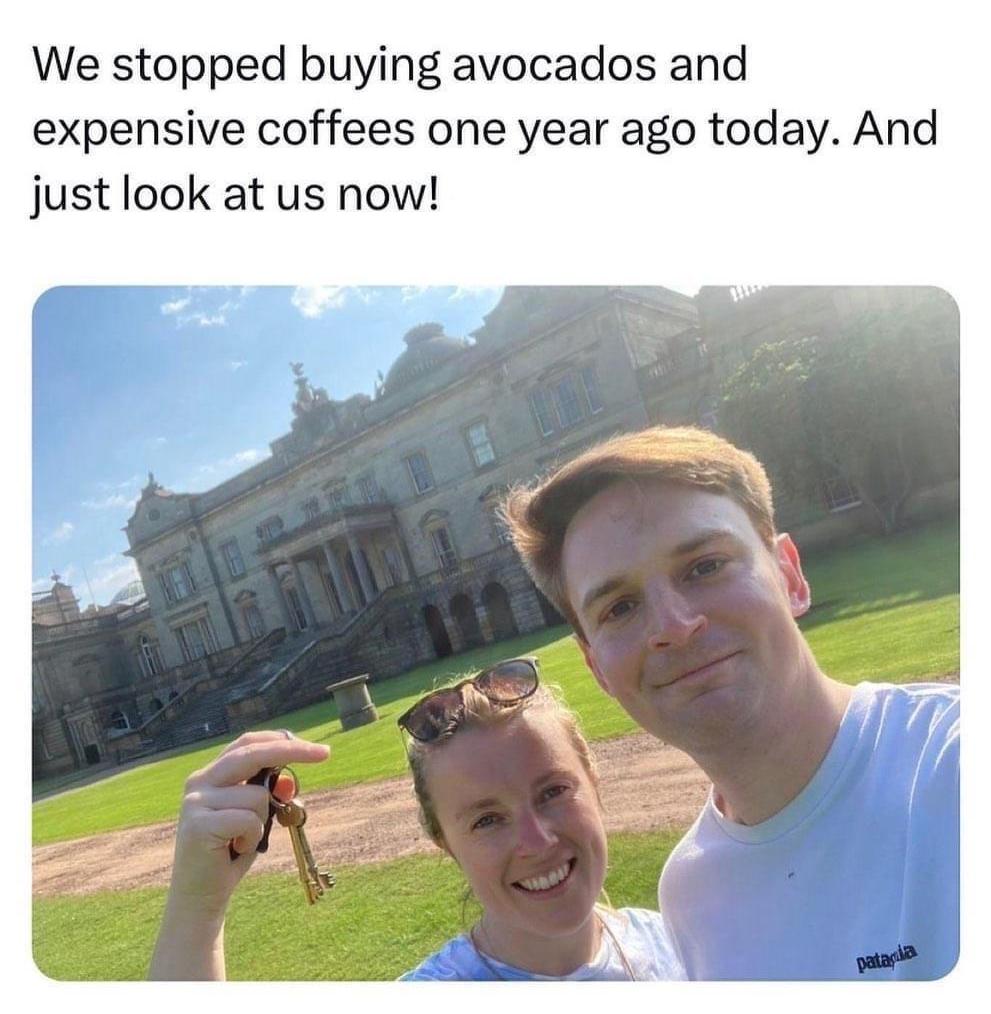

For years, the stereotype has been of a typical millennial that spends too much money on Sunday brunch and weekday coffees, who demands to live in a mansion. In fact, one of my favourite memes in this regard can be seen here:

That’s a shot across the bow to another stereotype: the Baby Boomer who always refers to “kids today” and shakes their head at how the world has changed.

But somewhere in between lays a happy medium.

Get more homebuying content with these posts next:

- Is it a Good Idea to Buy a Home when interest Rates are High?

- How to Choose the Right Mortgage

- How to Find the Right Real Estate Agent

Defining Realistic Expectations

Somewhere in between lays a reasonable expectation of housing, based on demographic and finance, which also respects that times have changed.

I think we can all agree that, no, not every person in Toronto can afford, or should be able to afford a red-brick Georgian tudor home in Rosedale on a 50 x 150 foot lot.

To answer the question, “Is it possible to buy your first home in Toronto today?” We must first possess realistic expectations. And to have realistic expectations is to understand the difference between needs and wants.

A person might want a detached home in the central core, but do they need it? More importantly, can they afford it?

Many can, but many can’t.

Age, Job, Goals, it All Matters

And ultimately who can afford it will depend on personal finance, which may also be a function of age, occupation, etc.

Is it realistic for a 23-year-old couple to say, “We want a detached, 4-bedroom house in our budget?” Not on the whole, no. But there’s a chance these folks could be backstopped by their parents, or perhaps they’ve won the lottery.

But is it realistic to believe that a 23-year-old couple should be able to afford a detached, 4-bedroom house?

No. Of course not.

But this, again, is a realistic expectation, and much of the housing crisis that we face in the city has been exacerbated by unrealistic expectations.

Keep reading these posts next:

- The (New) Economics of Home Ownership

- Are You Aware of these Closing Costs?

- Homebuying Incentives You Need to Know About

A New Perspective on Housing in Toronto

There is no country in the world where the home ownership rate is 100.00%, nor is their any city where the same is true. When you consider that Toronto is the largest city in Canada, potentially the most popular, and potentially the very definition of a “world class city,” then the expectation that a person can afford what they want, when they want, where they want, becomes all the more unrealistic.

So at the risk of the preceding sounding pessimistic, let me now suggest that it wasn’t intended to be. It was intended to provide a much needed perspective on housing in our city.

Let’s say that a single, 26-year-old wants to purchase a semi-detached, 3-bed, 2-bath house on the east side of Toronto. Now, let’s ask, “Is it possible for this individual to buy his first home in Toronto today?”

Again, the answer is: it depends.

Does this individual possess the necessary 20% down payment? Does this individual’s income qualify he or she, based on today’s interest rates?

And what’s the expected price of this property? This could vary by $300,000 based on geography, condition of the home, features and finishes, and major drivers of value irrespective of the 3-beds and 2-baths, like square footage, parking, a finished basement, etc.

But what is this individual’s expectation?

If he or she is holding out for a mint-condition home, on a prime street, with a beautiful backyard, steps to the coffee shop, and with a driveway and a garden, then the expectations are only realistic if the budget is substantial.

Compromises Are Key

Real estate has always been about trade-offs. Or if you want to make this sound more positive, it’s about compromises.

For most individuals to buy their first home in Toronto in today’s market, they will ultimately have to make multiple compromises.

If you’re a buyer, play the compromise game!

- You want a freehold. Ask yourself, “Could I do a condo?”

- You want a detached. Ask yourself, “Could I do a semi-detached instead?”

- You feel that you need a 4-bedroom home. Ask yourself, “Could we make do with 3-bedrooms?”

- Do you need a finished basement? Sure, you’d like one, but could you buy a house today with an unfinished basement and spend $150,000 less, then plan to finish the basement for, say $100,000 in five years, thereby saving today and gaining equity down the line?

- You want a parking space that’s owned. But would you settle for street parking in order to afford the home that you desperately want, in your desired area, on your favourite street?

The more compromises that a buyer makes, the more options he or she will have. But most importantly, this is the path to affordability in our market.

So, let’s ask again: is it possible to buy your first home in Toronto today?

I don’t think our answer has changed, but I think the process of answering the question becomes a lot more clear.

If you’re in the market for your first home, we’d be happy to help you on your journey. Reach out at any time by calling 416.642.2660 or emailing admin@torontorealtygroup.com. We’re always happy to chat!

Ready to Get Started?

It all starts with a conversation. Whether buying or selling, TRG can help you achieve your real estate goals. Get in touch with our team today to start the process.