If there is one constant comment heard in our real estate industry, it’s that homes are too expensive and in short supply. And from our perspective as evidenced on the infamous Toronto Realty Blog things aren’t about to change any time soon. In fact, the term housing crisis seems to get thrown around in the media so often now, that it’s diminished the true meaning of the word “crisis”. And whether you’re a conservative or liberal leaning voter, you might disagree with how much of a role the government should play in solving this issue. But you’d all likely agree that the government needs to do something. And over the years, various governments have stepped in, usually with mixed success. Here’s a brief list of government home buying incentives that can help get you on the market.

Home Buyers Plan

One of the ways the federal government has been trying to provide an easier path to home ownership is through tax relief. The first and easiest way they implemented this was to allow people to use their RRSP for the down payment of a home. This was set in place back in 1992, and essentially allows people to save for a home using tax-free income. The maximum amount one can withdraw in this way is still only $35,000, so it’s not providing a ton of relief for Torontonians, but since inception roughly 650,000 Canadians have removed $6.2 billion dollars from their RRSP to get onto the property ladder, so it’s clearly had an impact.

Tax Free Savings Account

Seventeen years later the government also introduced the Tax-free savings account, which wasn’t specifically for home ownership, nor did it provide tax free dollars for a purchase. But it has allowed buyers to grow their savings tax free over the last 14 years. To date you would have been able to deposit another $88,000 into a TFSA and almost every one of our first-time home buyers use these funds to get into the market.

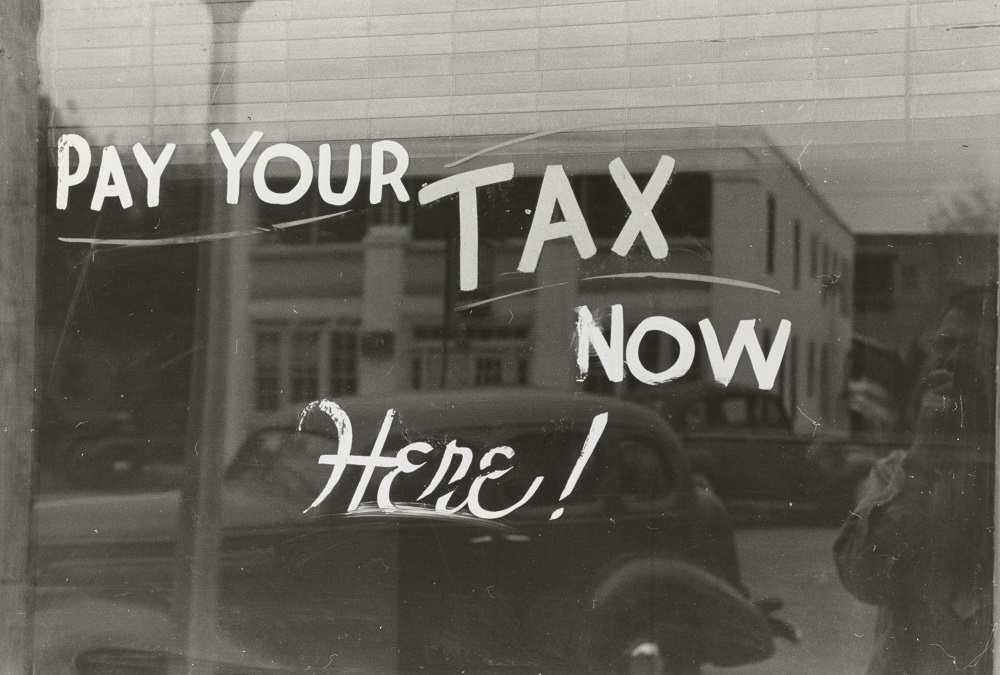

Tax Rebates

Rebates are perverse home buying incentives when you consider that they are refunds to the additional taxes the government had previously imposed. I actually think increasing the rebate for first timers is the easiest and most direct way of helping more buyers get onto the market. There are currently various land transfer tax rebates throughout Canadian provinces and cities for first time home buyers. But Ontario this rebate amounts to only $4000 with an additional $4475 if you’re purchasing in Toronto – you can calculate your total rebate here. But to my initial point, prior to 1974 there wasn’t any transfer tax in Ontario at all. And I know every little bit helps, but even after the rebates currently given to first timers, there can still be a substantial amount of transfer tax still owing.

The First Time Home Buyer Incentive

The first time home buyer incentive helps first time buyers by essentially loaning them an additional 5% to 10% of the down payment for a property on favorable terms. The amount you can qualify for is income dependent, but essential the loan amount isn’t due back until you sell the property. At the time of sale, you’ll owe 8% annual simple interest on the amount borrowed. But when you consider the length of time you are likely to have the loan interest free for, and the expected capital appreciation you’ll realize as a property owner over that time, it’s a good deal for many.

The Tax Free First Home Savings Account (FHSA)

This is a new home buying incentive tabled by the federal government which built upon the initial RRSP eligibility for home purchases. This new plan (FHSA) would give first time home buyers another $40,000 in tax free savings to apply toward a home purchase. The Bill initiating this new savings program is still in the works, but we should expect some more news on this later in the year. Although this program will not combine with the first-time home buyer’s incentive, along with savings made within an RRSP, TFSA, and eligibility for rebates – I’d say these government home buying incentives to get first timers into the market are really starting to add up.

Want More Insights From TRG Experts?

Sign up here to receive Insights Magazine delivered to you. This resource is full of market advice and industry intuition from our team and colleagues to keep you up-to-speed on the ever-changing Toronto real estate market.