How often does the Toronto real estate market change?

It’s a simple enough question but the answer depends on the type of change and the impact that it could have on the market and its participants.

If a prospective buyer is looking for a property type that’s currently trading for around $500,000, but that buyer is only pre-approved for $350,000, would that buyer be smart to “wait for the market to change?”

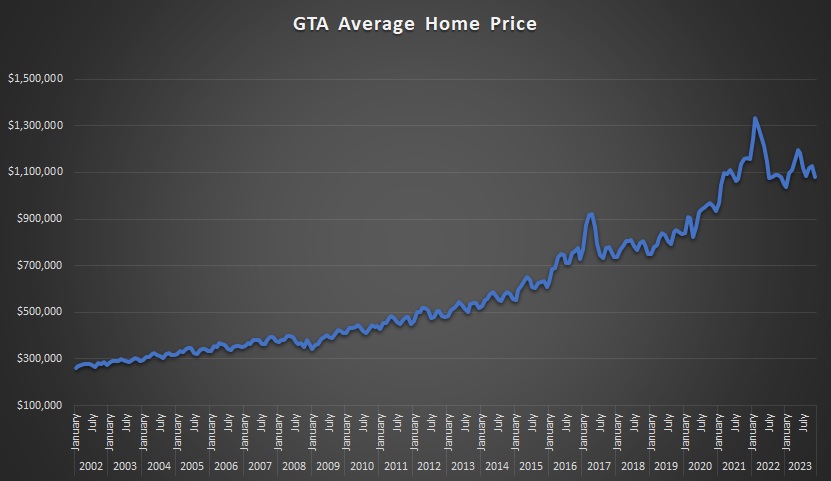

Based on the trajectory of the average home price over the last twenty years, probably not.

Curious about the real estate market in general? Download our latest Insights Magazine right here.

What Does Change in Real Estate Really Mean?

But change means different things to different people, and just because a market can’t drop 30% doesn’t mean that it can’t change at all.

If we were to simply graph the GTA average home price on a monthly basis over the last twenty years, it would look like this:

That’s what I would call a “long-term, uptrend” if I’ve ever seen one! If you were to suggest, “The market has done nothing but go up for twenty years,” you’d technically be correct.

However, within that long-term trend, we can clearly see two periods of decline – one in 2017 and one in 2022.

In those periods, the market clearly changed, and the change was quite pronounced.

Get more insights on the market when it comes to buying and selling with these posts next:

- Is Real Estate a Good Investment?

- Why Your Home Isn’t Selling

- Are Discount Real Estate Agents Worth It?

Charts and Stats Aren’t Everything

But what that chart doesn’t show is that in 2008, the average home price declined by 10% in a period of a few short months. Why the chart doesn’t show this is because the prices back in 2008 were so low, compared to 2022 and 2023, that a 10% drop is literally a “blip on the radar” by comparison.

Prices are only one way in which we can measure, define, and announce a market “change” but also consider the relationship between supply-and-demand and how that affects the inner workings of the real estate market.

Buyer’s Market Vs. Seller’s Market

We often hear the terms “buyer’s market” and “seller’s market” used at various points in a particular market cycle, but how do we define those terms?

The ratio of sales to new listings helps us look at something called “absorption rate,” or simply how quickly inventory is being absorbed by the market. We also call this the “sales-to-new-listings ratio” or SNLR.

When the SNLR is above 50%, it’s said to be a seller’s market.

When the SNLR is below 50%, it’s said to be a buyer’s market.

There are times in our market where the SNLR is in the 70-80% range and this is what we call a “tight” market where there’s so little inventory compared to the demand.

Then there are other times in our market where the SNLR is down in the 30% range, which is exceptionally-rate, but it does happen. This would be the result of a market where sales are scarce, regardless of inventory, since it is a ratio, after all.

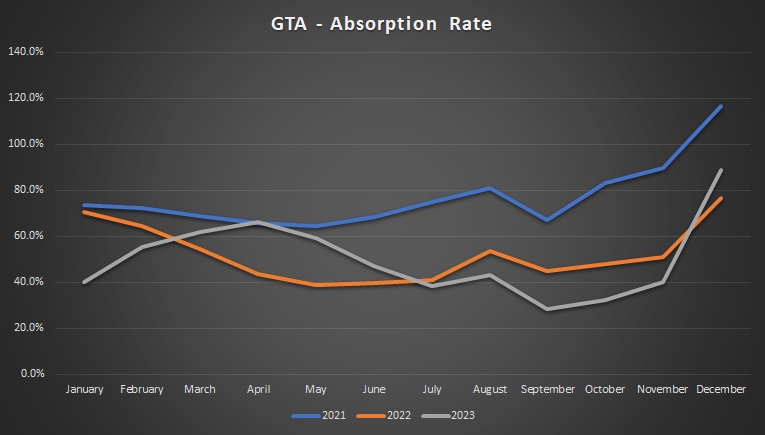

Here is a chart that looks at the monthly absorption rate over the last three years:

The fall of 2021 was a red-hot seller’s market, and the SNLR or “absorption rate” backs that up, seeing as the figures from August through November were 81.0%, 67.1%, 83.3%, and 89.8% respectively.

But the fall of 2023 was one of the worst markets we’ve seen in a long time, and although prices didn’t actually decline, sales were slim as buyers weren’t pulling the trigger. That’s evidenced by the respective absorption rates of 43.1%, 28.6%, 32.3%, and 40.2% from August to November.

As I said – the prices didn’t actually decline in those months, but they didn’t increase either. In a market like Toronto, where prices have essentially increased for two decades, stagnant growth in price is a big “win” for buyers, especially when inflation is running hot.

Get more real estate advice with these posts next:

What About Timing?

But also note something rather odd in the chart above: the absorption rate is always the highest in December.

Does this mean that this is a red-hot seller’s market?

No. And in actual fact, this is often the best buyer’s market of any month in the year!

Wait, isn’t that counter-intuitive? Doesn’t a high absorption rate mean a seller’s market?

Typically, but not always, and this is why it’s so important to understand the data! An experienced real estate agent knows the reason and can explain it, otherwise, the data can be completely misleading.

Nobody lists in December. Period. It’s the month of the year when new listings are always the lowest, however, because it’s such a great month to buy, the sales don’t decline in tandem. So with sales higher and new listings lower, the absorption rate always rises.

Now, why is December such a great month in which to buy?

Because it’s the “last chance” for a seller with a stale listing, to move the property before year-end. With Christmas and New Year’s representing a real estate dead zone in the calendar, most sellers realize that the market dies out mid-month. Sellers are usually more negotiable in December as it represents “the devil you know” rather than “the devil you don’t” in terms of the market the following year.

So while the absorption rate or SNLR can be used to determine if a market is in “buyer,” “seller,” or a “balanced” state, there are exceptions to the rule – like the month of December.

I would argue that the last type of “change” we see in the real estate market is with respect to choice.

The Buyer Can Choose

I always ask my buyer clients, “Would you rather pay a little bit more for a property but have a slew of options to choose from? Or would you rather pay a little bit less but really only see one place that fits your criteria?

The answer to this question might ultimately determine whether a buyer should be looking in low-season or high-season in terms of inventory and new listings.

New listings might be low in January and February, but the prices will rise by April and May when the inventory often doubles.

A buyer looking for a house or condo early in the year won’t be seeing 5-10 properties per week but will likely have less competition and pay slightly less than he or she would in “prime” months in spring and early summer. In those months, new listings for the calendar year are always peaking, so there will simply never be more to choose from! But would the buyer pay a premium for that choice? Because that’s what happens almost every year.

So while the market can change from an inventory perspective, an active buyer really, truly should decide in advance whether choice or price comes first on the list of factors affecting the search.

Change Happens, It’s a Fact

Over the course of a season, a calendar year, or a 3-5 year market cycle, there is going to be change in the market. Prices, market conditions, competition for listings, and market inventory will fluctuate, and while any market is difficult to “time,” there are common patters in the Toronto real estate market cycles.

An experienced real estate agent knows what to look for because he or she has worked in each and every type of market, over and over.

What type of market are we in right now? Feel free to reach out and we’ll chat about it! Give us a call at 416.642.2660 or email us at admin@torontorealtygroup.com.

Ready to Get Started?

Sign up here to receive Insights Magazine delivered to you. This resource is full of market advice and industry intuition from our team and colleagues to keep you up-to-speed on the ever-changing Toronto real estate market.

It all starts with a conversation. Whether buying or selling, TRG can help you achieve your real estate goals. Get in touch with our team today to start the process.